UAB or MB which one to choose and why?

Updated: 2024-01-26

UAB (in Lithuania called Uždaroji Akcinė Bendrovė) also known as a private Joint Stock Company and MB (in Lithuania called Mažoji Bendrija) known as a Small Partnership company, both have the same legal form, they are both limited liability companies and you are not liable with any of your personal assets in case of any business failure, debts accruing and not having enough means in the company to covers whole liabilities. The whole business liability falls to the company assets only, debtors will not have any right to recover debts from business owners as natural persons. These are two the most popular company forms of business types in Lithuania nowadays. There is another one of company form in Lithuania called “Individuali įmonė” which is known as Individual enterprise, which owner is fully responsible for all liabilities by his own personal assets. We do never recommend registering such company form, neither we assist registering it.

Let’s begin with some history and statistics. UAB as a company registration form has been legally announced and registered in 1990, since then UAB had more than 120 various changes in its legal law. Usually speaking, without going in every detail, the law article consists of 89 full pages of various UAB regulations and management. While MB has been legally announced and registered in 2012, since then it had only 8 changes in its legal law and the law article consists of only 18 full pages of various MB regulations. It is almost 5 time less regulations! Even a non-legal matter related persons is capable to read, study and understand the basics of MB management in a short period of time, which cannot be told the same about UAB legal matters.

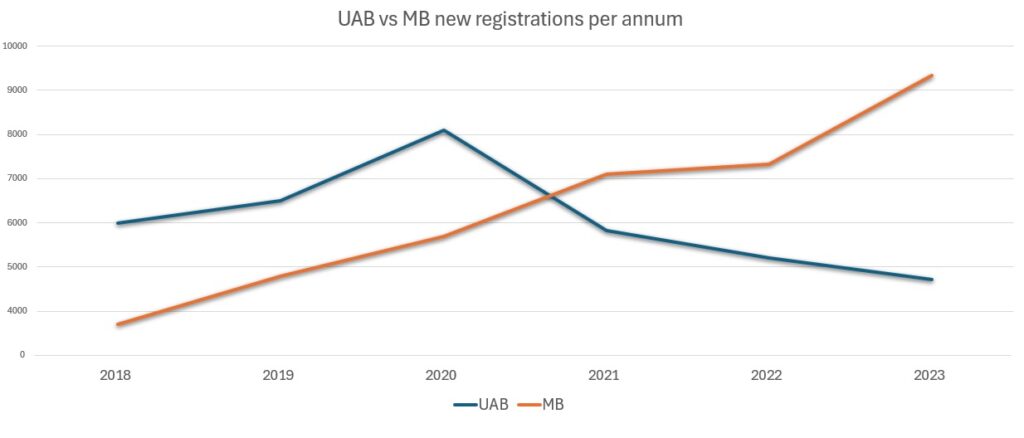

Now you may generally evaluate how complex is the legal management complexity of the UAB company type. Therefore in 2012 Lithuanian government has announced a new legal form which would make the small business (by the local law small company is counted as having less than 50 workers and annual turnover is under 10 million Eur) to run more easier, simple and less complex. Since then MB registrations are increasing each year and in 2020-2021 it even exceeded UAB registration numbers, while during COVID-19 pandemic new businesses are looking how to optimize business running expenses and in all possible advantageously ways compete with other companies in Lithuania or abroad by reducing their prime costs.

Let see now in the chart how each type of company did in the last few years:

Statistics source: State Enterprise Centre of Registers

The attractiveness of small partnerships (MB) among founders of new legal entities in Lithuania has been observed for the last four years. The turning point was 2020, when for the first time in the country the most popular form among new legal entities was the small partnership, instead of the leading closed joint-stock (UAB) companies for a long time.

The popularity of the small partnership form is determined by several reasons, among them – a clear and simple registration process, quick establishment, as well as limited liability – its members are not responsible for business obligations with their personal assets, they only risk their contribution. In comparison, the owner of a sole proprietorship is liable with all his personal assets.

A small partnership does not require a minimum authorized capital. Tax incentives are also available for newly established MB. In the first tax period, the profit is taxed at 0% corporate tax rate, if the number of employees in the MB company does not exceed 10 people and the annual income does not exceed 300 thousand Euros.

In terms of its operation and management, this form of MB is not much different from a UAB company, but this legal form has a load of tax and social tax benefits compared to UAB.

So what is the actual difference between them?

Let’s dive into more details comparing these two company types. Here we will review the major and most important differences in-between. Small partnership MB founders and owners can only be natural persons (limited to maximum 10 members) while Joint Stock Company UAB shareholders can be natural persons and legal entities as well (limited to maximum 250 shareholders).

There is 1,- Eur minimum capital requirement for setting up a Small Partnership MB company. Establishing a Joint Stock Company UAB, the capital must be minimum 1’000,- Eur. In both cases the capital cannot be less than a minimum specified. It is always possible to get the share capital size to be increased in one or another type of the company as required by the client.

After registering one of the companies and willing to transfer its ownership to another person different actions have to be carried out in each case. Since 2015 UAB company ownership transfer requires to sign the share transfer agreement in front of the notary at the local notary pub in Lithuania, therefore the personal presence is required or Legalized POA has to be issued to another person to act on behalf of a buyer to sign the share transfer agreement. MB company ownership transfer does not require to involve notary pub and can be transferred remotely without the new owner personal presence in Lithuania. It saves a lot of time and expenses as well.

Small Partnership MB members are the founders of the partnership and they can work in the partnership without concluding an employment contract with the company, they conclude a different type of agreement which is called “Management agreement for the small partnership”, therefore saving a lot on salary tax expenses. There is no obligation to pay any fixed salary and related taxes per month. Taxation for partners working in the company under management agreement is only 15% of income tax and there is no minimal salary or minimal salary tax requirement.

Another advantage of MB is that there is no obligation to hire qualified accounting services in Lithuania to look after your bookkeeping, no matter if you are doing any business or not. Partnership accountings are much more simplified. If it is not a VAT license registered company and only company owners are working in the company, then accountings can be done once per year and members are allowed do the accountings of the partnership by their own or hire any persons or accountant to do it on behalf of them.

Joint Stock Company UAB shareholders are the owners of the company but they are not allowed to work in the company just because they are company owners. If they want to work and act on behalf of the company, employment contract must be concluded with them. And while concluding an employment contract with any person, it has a minimal allowed salary and related taxes set by the government as an obligation. In 2022 minimal salary is set to 730,- Eur/month before tax. Taxes will make up 196,35 Eur/month and net salary of 533,65 Eur/month will be paid to the employee after deducting taxes. The funny fact is that if you will not pay the salary to the employee the minimal salary taxes must be paid, otherwise government authorities will deduct the required amount automatically from your business bank account in Lithuania, and if there isn’t sufficient means, the bank account will get suspended and it will go to a negative balance. It is mandatory to hire a qualified accountant to do the bookkeeping due to more complicated accounting and it does not make any difference if you are doing business or not, the accountant has to be hired and dedicated in the company after its registration, as it is an obligation set by the UAB law.

Another fact about the owners of the companies. In MB owners may withdraw from the company by their own will at any time by retrieving their contributions from the company, while in UAB they cannot withdraw from the company by their own will, they will have to find someone who would buy his company shares and will become a new shareholder of the company instead of him, as well it will require a notary approval on share transfer agreement.

What about visa matters?

We are always concentrated towards our client success, therefore we always screen legal, tax and immigration regulations to offer the best option for the fresh business startup in Lithuania with minimum required investments. Since the last couple of years we cannot justify UAB maintenance cost for companies which are runed by one or even few persons. We have started dealing with MB type companies for the persons willing to start a business and apply for a business short term C type, long term D type visas or residence permit. It works the same way as UAB company, even preparing the business visa for Lithuania application is more easier due to less documentation required, nevertheless it helps to save some additional expenses and keep the further management less complex. By all means of the law these two companies have equal rights just different obligations to fulfil in daily management tasks.

Summing up

We have to admit that MB is taking the UAB place in recent yeras. Just some persons or legal consultants prefer sticking to “old good things” and do not wish to get along with the new opportunities. But as we saw tts registration numbers are increasing, people are starting to notice its advantages and less complex management over UAB company type. As minimal allowed salary and related tax expenses are increasing each year it is getting wiser to keep a freedom and more flexibility in basics expenses like deciding how much and when you wish to pay the salary. As we are dealing with small scale international business investors (having less than 50 workers and annual turnover is under 10 million Eur) we always propose our clients to choose a small partnership business form. No worry, it is always possible to convert MB into UAB during the life of the company and vice versa. The only practical case whenever we do suggest registering UAB company is in case the company owners will be legal entities.